Traditional capital markets have long revolved around a handful of asset classes — equities, bonds, commodities, real estate. Together, they define how value is created, stored, and traded. But as we enter the next decade of the internet economy, a new asset class is emerging, one that powers every digital interaction, transaction, and connection we make: bandwidth and connectivity infrastructure.

Welcome to the era of Internet Capital Markets (ICM)!

What Exactly Is Internet Capital Markets (ICM)?

Internet Capital Markets are a next-generation model of global finance. Instead of relying on legacy banking infrastructure, intermediaries, and geographic access, ICMs enable all forms of value on a single internet-native ledger. Assets can be represented, owned, traded, collateralized, and settled entirely on-chain.

– Akshay BD, Explaining ICM at Token 2049 Singapore, 2025.

Solana’s ecosystem messaging frames this as “anyone with an internet connection should have access to capital markets” — tokenization reduces issuance friction and broadens ownership beyond institutional walls, making capital markets accessible to people who previously were merely consumers.

Independent explainers and developers also echo this idea: tokenization and on-chain market mechanics permit a future where asset issuance and ownership are highly democratized, enabling direct participation in assets that historically required large capital or institutional access.

In essence, anyone who has access to the internet can now also have access to capital markets, not just by trading tokens or stocks..

The Problem: Unequal Access to the Internet and Its Value

Even in 2025, over 2.6 billion people worldwide still lack reliable internet access. Billions more are connected, but only as consumers, not as stakeholders in the networks they use.

This means two things:

- A massive untapped market for internet infrastructure.

- A missed opportunity for billions to participate in the financial upside of the ICM economy.

This is where Dabba Network comes in.

Turning Internet Into an Asset Class

Dabba Network, built on Solana, is not just building a decentralized physical infrastructure network (DePIN). Through Dabba, bandwidth itself becomes tokenized, and connectivity infrastructure becomes an asset class — an asset that generates both yield and utility.

Here’s how:

- Hotspot owners from anywhere in the world purchase Dabba hotspots.

- Local Cable Operators (LCOs) in India deploy and operate these hotspots.

- Users consume the internet through this network, generating real usage data and revenues.

- These revenues flow back to hotspot owners and LCOs as on-chain rewards in $DBT, Dabba’s native token.

- As more data is consumed, more $DBT is burnt creating a deflationary pressure.

The result?

Every connected hotspot becomes a yield-bearing digital asset.

Every byte of data consumed adds value to the network — and to the tokenized ecosystem that represents it.

Building A New Asset Class

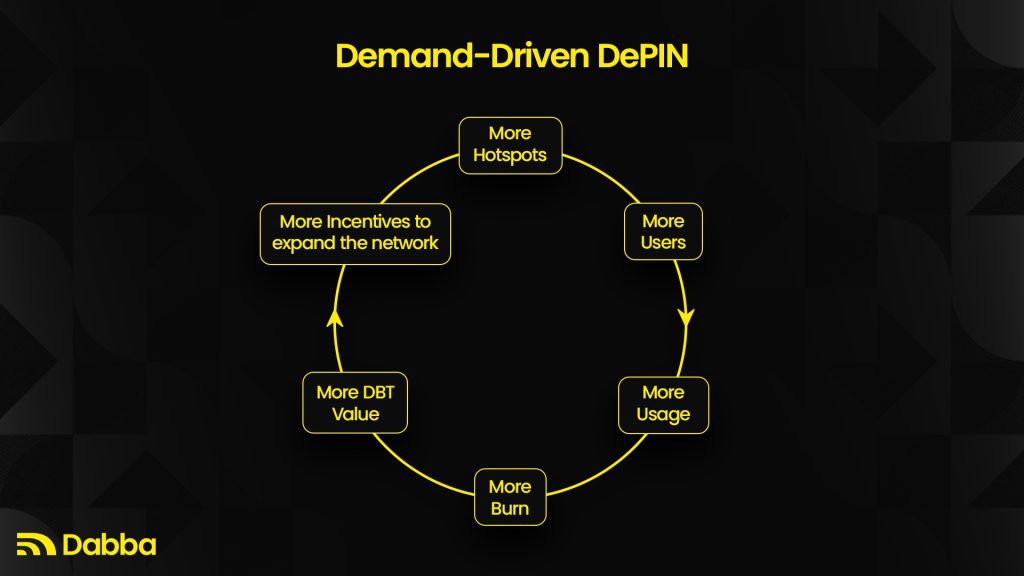

The Dabba model forms a self-reinforcing economic flywheel that connects real-world infrastructure growth with on-chain liquidity and value creation:

- Infrastructure Tokenization: Dabba hotspots represent a new class of real-world, tokenized assets.

- Network Expansion: These sales fund real deployments — more hotspots, lower costs, and greater coverage.

- Bandwidth as Yield: As users consume data, on-chain revenues and rewards increase.

- Liquidity Access: Through mechanisms like the Genesis Liquidity Program (GLP) and Dabba Vault, liquidity from traditional and Web3 markets flows into the network.

- Mainstream Adoption: Lower bandwidth costs and higher connectivity bring millions of new users — traditional and Web2 — into Web3.

- Tokenized Value Creation: Both revenue and infrastructure get represented on-chain, forming a new, scalable asset class on Solana.

- With increased data consumption on the network, more $DBT is burned creating a deflationary pressure consequently increasing the value of $DBT.

Let’s put this into perspective.

The global broadband market is projected to exceed $500 billion by 2030, and the overall internet services market already surpasses $1 trillion annually. Yet, none of that value today is directly tokenized or accessible to Web3 participants.

With Dabba’s infrastructure running on Solana, that changes. Every deployed hotspot, every byte transmitted, every tokenized reward contributes to building a new asset class on-chain — the Internet itself.

Just as stocks represent ownership in companies and bonds represent claims on debt, Dabba represents ownership in the digital infrastructure that powers connectivity.

Market size: The Economics Behind the Dabba Building Internet as an Asset Class

Quantifying the opportunity matters because Dabba not only creates access to capital markets but also brings real revenue on-chain.

- Industry estimates for India’s broadband services market vary by methodology, but they converge on a large and growing opportunity. One respected estimate places India’s broadband services market at ~USD 16.3 billion in 2024, with healthy CAGR forecasts into the 2030s.

- Other regional forecasts (longer horizon, alternate methodology) project even larger numbers — for example, some outlooks estimate India’s broadband services could approach USD 100+ billion sized opportunity by the end of the decade under aggressive adoption scenarios (different research firms use different definitions).

- For context, the global broadband services market is already measured in the hundreds of billions annually (global estimates around USD 400B+), so India is a material slice of a massive global pie.

Even at conservative estimates, the annual Web2 revenue pool tied to connectivity in India is billions of dollars every year — and that is precisely the economic base Dabba can tap into and partially channel into Web3.

From DePIN to ICM: Bridging Real and Digital Economies

The broader DePIN (Decentralized Physical Infrastructure Networks) movement has been about decentralizing access to and ownership of real-world networks — from sensors (WeatherXM) to compute (Render) to mobility (Helium).

But Dabba takes it one step further. It’s the Layer-0 DePIN — enabling others like WeatherXM and Wingbits to deploy faster and cheaper through its connectivity network.

This model not only helps other DePINs scale, but also strengthens the ICM thesis — real-world physical infrastructure as on-chain capital.

Every DePIN that scales through Dabba adds to the liquidity, diversity, and depth of the Internet Capital Market being built on Solana.

Why Internet Capital Markets Matter

In traditional finance, access to capital markets has always been limited — to those with capital.

In Web3, Dabba is flipping that narrative:

“Anyone with an internet connection should also have access to the markets that power it.”

By converting connectivity into an investable digital asset class, Dabba isn’t just connecting the unconnected — it’s financially including them.

This is how traditional finance flows into Web3, how real-world infrastructure meets on-chain liquidity, and how the next billion users join the decentralized economy.

The Road Ahead

If we think of the internet as an economy, bandwidth is one of its most fundamental commodities. Tokenizing even a small share of India’s connectivity revenues can create substantial on-chain capital flows, deepen liquidity and make infrastructure financing far more democratic.

Solana’s ecosystem provides the rails, Dabba provides the real-world deployments and economic primitives. If India’s remaining addressable connectivity demand is unlocked, the result isn’t just more users online, it’s a new asset class on-chain, with real yield, tradability and impact.