India is undergoing a quiet digital revolution. More and more households are moving away from traditional cable and satellite TV in favor of connected TVs (CTVs) and internet-enabled entertainment. This shift, often referred to as “cutting the cord,” is reshaping how Indians consume content and, more importantly, is accelerating broadband penetration across the country.

The Rise of Connected TVs in India

According to recent industry reports, India now has over 48 million connected TV households, a number that has surged in the past few years. This includes smart TVs and other connected devices such as Fire TV Sticks, Chromecast, and internet-ready set-top boxes. The trend is more likely to continue as over 65% of Indian viewers say they prefer internet-connected TVs over traditional cable TVs.

The reasons behind this trend are manifold:

- Affordability of Smart TVs: As hardware costs decline, smart TVs have become accessible to middle-income households.

- Rise of OTT Platforms: Services like Netflix, Amazon Prime Video, JioCinema, and Disney+ Hotstar have exploded in popularity.

- Younger Demographics: A tech-savvy youth population is driving digital-first content consumption habits.

Changing Viewer Behavior

With the rise in connected devices, viewer habits have also transformed. Recent studies show that nearly 23% of Indian consumers have gone fully digital, cutting ties with traditional cable and DTH services. Furthermore, 80% of current linear TV viewers in India say they plan to switch to CTV platforms within the next year.

On average, CTV viewers spend three hours per day on these platforms, often during prime time. Shared and interactive viewing experiences are becoming the norm, especially in urban households.

Surge in Advertising and Economic Impact

The CTV (connected TVs) boom is also shifting the dynamics of the Indian advertising ecosystem. In 2024, CTV ad spend in India reached ₹1,500 crore (~$180 million). Experts project this number to grow significantly, hitting nearly $500 million by 2027.

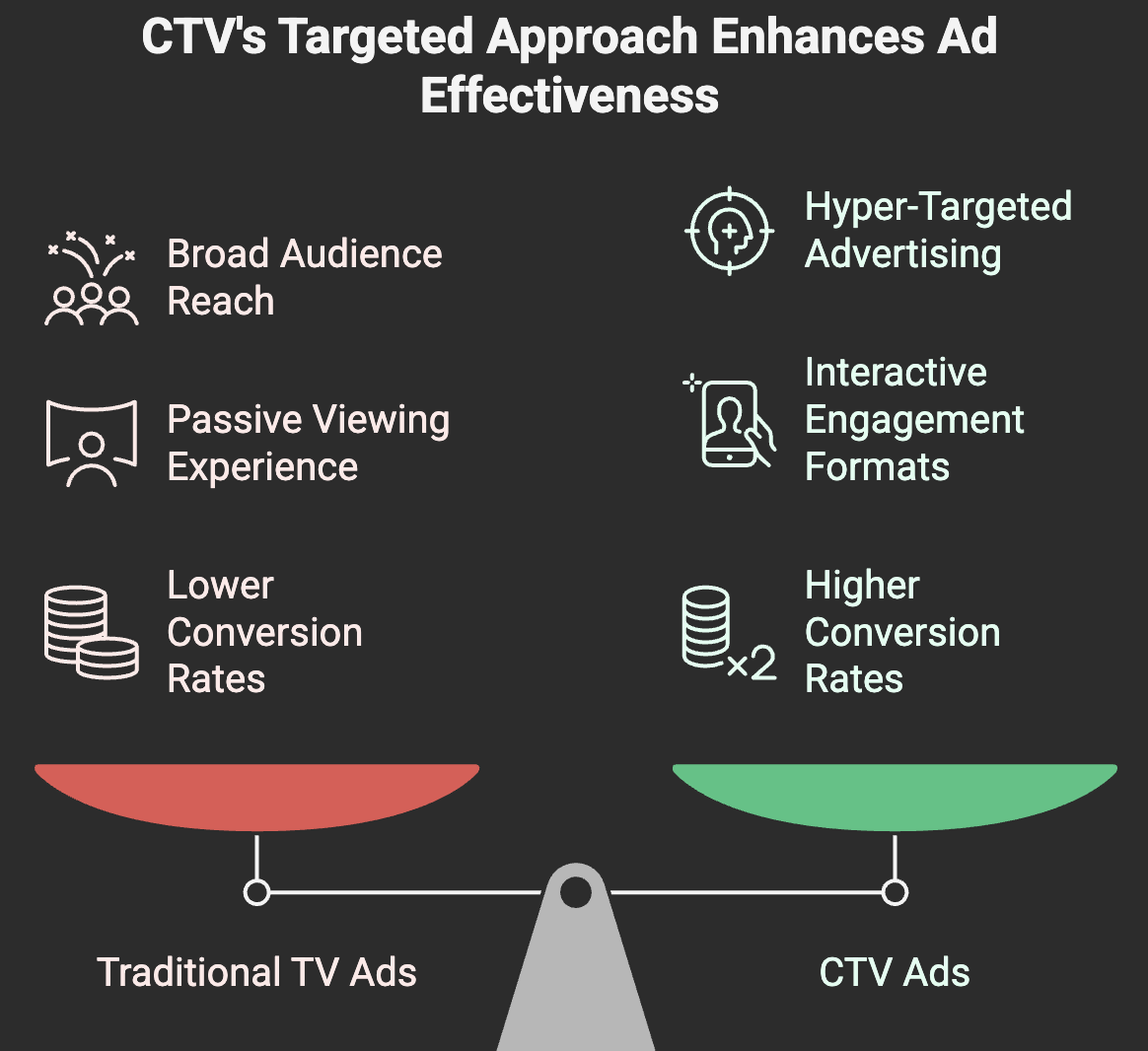

Key reasons for this surge include:

- Personalized Ads: Unlike traditional TV, connected platforms enable hyper-targeted advertising.

- Interactive Formats: Ads on CTVs are more engaging and often allow direct user interaction.

- Increased ROI: Brands are seeing better conversion rates from CTV campaigns due to data-driven targeting.

CTV now accounts for 10% of total TV ad revenues, and this share is expected to grow to 16% by 2026.

Why This Matters

The shift to internet-enabled media is more than a change in consumer preference—it represents a structural transformation in India’s digital economy. As broadband infrastructure spreads, it brings along opportunities for economic growth, digital literacy, and decentralized technology adoption.

Here are some of the broader implications:

- Wider Digital Inclusion: Rural and semi-urban regions are now accessing the same streaming content as metro areas.

- Education and Work: CTVs double up as learning and productivity tools, especially for students and remote workers.

- Boost to Dabba’s DePIN Model: Decentralized Physical Infrastructure Networks (DePINs), like Dabba Network, benefit from this broadband expansion as more users come online.

Cord-Cutting = Higher Data Demand = A Big Opportunity for Dabba

India’s accelerating shift away from cable and DTH TV services in favor of connected, on-demand entertainment is not just a cultural transition—it’s an infrastructure challenge. As more users switch to OTT platforms like YouTube, Netflix, and JioCinema, the demand for high-speed, reliable internet continues to soar.

Let’s put it into perspective:

- A single hour of HD streaming consumes around 1–1.5GB of data.

- With average daily screen time rising to nearly 7 hours in urban areas—and 3–4 hours even in semi-urban regions—data usage per household is skyrocketing.

- India’s average monthly data usage per user is already the highest in the world at over 20GB, and it’s expected to double to 40GB/month by 2027 according to Ericsson Mobility Reports.

This is where Dabba’s opportunity becomes crystal clear.

Unlike traditional broadband providers that struggle with high costs and slow rollouts in semi-urban and rural areas, Dabba’s decentralized model, powered by Local Cable Operators (LCOs), is designed for scale and speed. Our layer-0 DePIN (Decentralized Physical Infrastructure Network) enables:

- Quick deployment of hotspots in high-demand, under-served markets

- Guaranteed data consumption, thanks to our managed deployment model where no hotspot goes live without a paying customer

- A clear burn mechanism that ties real-world data usage to $DBT tokenomics—meaning every binge-watch session on a smart TV in a Dabba-connected home contributes to token value

As more Indian households cut the cord and plug into connected TVs and smart devices, the demand for localized internet infrastructure will explode—not in theory, but in practice. With more than 126,000 connected devices, 11,500+ TB of data consumed, and 10 active LCOs, Dabba is already proving that our model can scale to absorb this demand efficiently.

Looking Ahead

India is well on its way to becoming a fully connected nation. With a population of over 1.4 billion and an internet penetration rate of just over 50%, the upside for digital platforms and broadband services remains enormous.

The rise of connected TVs and shifting streaming behaviours is both a cause and a consequence of this growth. Dabba’s decentralised internet model is ready to meet this change and cater to the growing data demand.